6.3.2019

A Message from CT REALTORS® and the CT Homebuilders & Remodelers on the “Mansion Tax”

Dear Legislator:

Recent media reports have indicated the tentative framework of the proposed budget includes a so-called “mansion

tax”, an additional statewide conveyance tax on homes selling at or over $2.5 million.

Connecticut’s real estate market remains extremely fragile with exceedingly slow sales at the upper end of the

market. Many selling their homes have little to no equity so any additional burden will make it more difficult for

sellers to be able to afford to sell their homes.

Reports from OPM confirm that Connecticut is experiencing the lowest home price appreciation in the country – with

less than 1% growth over more than a decade.

The proposal will add to the crush on our home values as increases in real estate transactional costs drive down sales,

prices and home equity.

Those who may otherwise consider moving up or moving down to other properties in Connecticut may find those

added costs are the last straw in their consideration of a move. Every move in real estate generates money

throughout the Connecticut economy – and every move that doesn’t occur further slows economic growth.

Connecticut REALTORS® (CTR) conducted a survey of the public in February 2019 which indicated nearly half of

Connecticut residents plan to leave the state. The top reasons for plans to move included high property taxes (33%),

high income taxes (29%) and high estate taxes (9%).

CTR President Dan Keune relays, “We appreciate the efforts being made to keep wealth in our state and balance our

state budget. The State needs to minimize the impact that out-migration has been having on everything from payroll

income to charitable giving, to property taxes, to local spending. A ‘mansion tax’ sends another negative message

about living, buying and working in Connecticut.”

The Home Builders & Remodelers of CT share similar concerns. HBRA of CT President Chris Nelson explains,

"The Connecticut residential construction industry has never recovered from the Great Recession and a ‘mansion tax’

will only serve to exacerbate this trend, especially for our developers in Fairfield County and shoreline communities

who may only build one or two of these high-end homes a year. The Home Builders & Remodelers Association of

Connecticut urges the legislature to please consider spending cuts, the use of the Rainy Day Fund or a combination

thereof, in lieu of a conveyance tax that would negatively impact our already distressed industry."

Thank you for your consideration in not including any new or expanded real estate taxes in the budget, including an

expanded “mansion tax”.

Read More

CBIA Legislative Alert

Lawmakers could vote at any time on a new state budget and tax package that reportedly includes a $53 million income tax hike on most small businesses.

Last year, the legislature implemented a new tax on pass-through entities (LLCs, LLPs, partnerships, sole proprietorships, S Corps) with an offsetting income tax credit to mitigate federal caps on state and local tax deductions.

However, that program—meant to support Connecticut small businesses—is now being targeted as a new source of revenue to help fund ever increasing state spending.

Please contact your state legislators immediately.

Ask them—where are the spending cuts? Why are they targeting Connecticut small businesses?

And tell them to oppose any additional burdens on small businesses, the engine for job growth in Connecticut.

State lawmakers will soon act on legislation mandating 12-14 weeks annual paid leave at 100% of salary, capped at $1,000 weekly, for all private sector workers in Connecticut. Employers will shoulder additional administrative burdens involved with juggling new workforce demands to accommodate employees on leave while continuing to provide non-wage benefits for employees absent for up to three months annually. Connecticut’s proposed leave benefits are far richer than those in neighboring states, while the eligibility threshold is low.

Act now and make your voice heard!

New Laws Go Into Effect January 1

December 27, 2018

Several new state laws go into effect Jan. 1, including one that affects all employers with regard to hiring practices.

Under Public Act No. 18-8, employers are prohibited from inquiring, or directing a third party to inquire, about a prospective employee’s wage or salary history beginning Jan. 1. A prospective employee may, however, volunteer to provide such information.

Nomination of Judge Brett Kavanaugh

August 30, 2018

NAHB supports President Trump’s nomination of Judge Brett Kavanaugh as Associate Justice to the U.S. Supreme Court because of his extensive record as a highly qualified, principled and fair jurist. In the past 12 years serving on the U.S. Court of Appeals for the D.C. Circuit, Kavanaugh established a strong record of curbing regulatory overreach. During this time, he was involved in eight cases in which NAHB was a petitioner, appellant or amicus. While not always siding with NAHB’s position, Kavanaugh has consistently viewed agency rulemakings with a healthy dose of skepticism. For example, NAHB was a petitioner in Coalition for Responsible Regulation et al v. EPA, challenging EPA’s attempt to apply an onerous Clean Air Act permitting program to millions of new sources, including some multifamily buildings. A three-judge panel at the D.C. Circuit upheld EPA’s regulation, and the full D.C. Circuit did as well – except for Judge Kavanaugh. Ultimately, NAHB and its industry coalition took this case to the Supreme Court, which overturned EPA’s regulation for exceeding its statutory authority, just as Kavanaugh had forecast when he declined to go along with the D.C. Circuit’s full court ruling.

Learn more about Kavanaugh’s experience on the U.S. Court of Appeals.

Judge Kavanaugh’s confirmation hearing in the Senate is set to begin on Sept. 4. Contact your senators now and urge them to support his nomination.

Click here to contact your Senators!

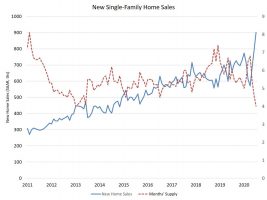

CT Housing Starts

August 20, 2018

While the rest of the nation sees economic recovery and housing booms, Connecticut continues to struggle evidenced by the charts below. Fairfield County’s 23 towns seem to fair well compared to the rest of the state but while other states are seeing record high permit numbers Connecticut has yet to bounce back. Connecticut’s taxes keep going up, the budget deficit is growing and each year it gets harder to do business here, more expensive to live here and exceedingly difficult to retire here.

For many people, owning a home is part of their American Dream. Homeownership builds stronger communities, provides a solid foundation for family and improves the quality of life for millions of people. It is truly the cornerstone of the American way of life. A healthy housing industry means more jobs and a stronger economy. Home building increases the property tax base that supports local schools and communities.

Fully 15 percent of the U.S. economy relies on housing. Constructing 100 new single-family homes creates 297 full-time jobs, $28 million in wage and business income and $11.1 million in federal, state and local tax revenue. We must continue to advocate for pro-business candidates in Hartford to help get our state back on track.

- 1,423 permits have been pulled in Connecticut through April 2018 (data not yet available through June)

- Fairfield County towns report 514 permits through June of 2018

- Greenwich shows the strongest activity with 83 permits followed by Westport with 65 and Stamford with 5

July 26, 2018

House GOP petitions to keep tolls debate going strong, CT Mirror

Minority Republicans in the House of Representatives are trying to petition the legislature into special session to block a planned study of electronic tolling — a move that may have greater implications for the fall election season than for the tolls analysis. Read more…

July 25, 2018

Bond Commission Approves $10 million for Electronic Tolls Study, CT Mirror

The State Bond Commission approved $10 million in financing Wednesday for an analysis of establishing electronic tolling on most Connecticut highways. After a nearly hour-long debate, the 10-member commission voted 6-3, with one abstention, to approve the funding proposed by Gov. Dannel P. Malloy. Read more…

May 22, 2018

Great news! The proposed mandate to include fire sprinklers in townhomes was unanimously rejected this morning. The Regulations Review Committee adopted new codes without this extra burden on home builders.

Thanks to the lobbying efforts of our CT HBRA CEO, Bill Ethier, and the countless members statewide who made phone calls, sent emails and showed up in person, we were successful in defeating this costly mandate which was expected to add $10,000 to the cost of a new town home.

Keep in mind that when you become a member of the HBRA of Fairfield County, you also become a member of the state HBRA, which lobbies on your behalf, as well as the National Association of Home Builders (NAHB).

We are lucky to have Greg Ugalde, a Connecticut Builder and member of Central CT HBRA, serving as the 1st Vice President of the NAHB Board. Today, he and past CT HBRA President, Norton Wheeler, and Chairman of the NAHB Board, Randy Noel, among others, met with Vice President Pence to discuss issues of importance: lumber tariffs, labor and land use regulations.

Nort reported that the Vice President is very appreciative of our industry and understands the impact building has on our nation’s economy. The lumber tariff and rewrite of NAFTA is going to take some time but it is a priority for this administration.

They also heard from White House staff on workforce development as well as the continued success of the administration to roll back overreaching regulations. The House of Representatives is expected to pass the Dodd Frank Regulatory Relief Act today. It does not repeal the act but it does loosen the regulations on community banks which should help builders gain project funding the old fashioned way, through our community banks.

It’s critical we remain in contact with our legislators at the local, state and federal level to ensure the voice of our industry is heard.

April 24, 2018

Aresimowicz promises House vote on tolls:

House Speaker Joe Aresimowicz, D-Berlin, said Tuesday he intends to call a vote next week on legislation making an initial commitment to implementing electronic highway tolls, despite Republican opposition that could brand Democrats as the party of tolls. Read more

April 19, 2018

How was your drive into work this morning? Are you sending crews out to job sites or to client’s offices? What if it cost you to get to and from work every day, never mind the driving you and your employees do in-between?

You may have heard that the Connecticut Finance, Revenue & Bonding Committee passed a bill in support of the implementation of tolls in Connecticut. The vote tally can be viewed here. Now that they have voted it out of committee, the Speaker of the House indicated he would call it for a vote on the House floor before the legislative session ends on May 9th. What does this mean for you?

The bill would give the Department of Transportation the authority to install tolls throughout the state. Contrary to public perception, it is illegal in Connecticut to place tolls only on the borders.

One study suggested putting up electronic toll gantries at 12 places along I-95 between New Haven and the New York line, with ten tolling spots along the Merritt Parkway. At 50 cents per station on I-95, a one-way, peak hour trip from New Haven to New York would cost a driver $6.

The Connecticut Transportation Finance Panel estimates it will cost $373 million to install the tolls, and that does not include the environmental impact studies, and studies of traffic diversion and economic impacts.

Another study said that 71% of the toll revenue would come from residents while only 29% would come from out of state drivers. Undoubtedly, the cost of doing business will go up and this legislation will have a direct impact on Fairfield County. It’s unclear the final package the legislature will be voting on at this time, but it’s imperative lawmakers understand how their constituents feel.

Call or write your legislator and let them know how you feel about tolls. It is critical they hear from you now before they cast a vote.

April 9, 2018

“The Appropriations Committee failed to meet its deadline to recommend spending adjustments. The Finance, Revenue and Bonding Committee offered a host of ideas that collectively would deepen the hole in the next budget — already at $265 million — by at least another $130 million. Malloy also has been waiting since early December for legislators to close a deficit hovering near $200 million in the current fiscal year, which ends June 30.” Read more here.

The Finance, Revenue & Bonding Committee passed a bill in support of implementing tolls in Connecticut. The vote tally can be viewed here. A State Representative from Trumbull & Fairfield articulates the very real and negative impact it would have on Fairfield County. Click to watch her remarks.

April 2, 2018:

Tuesday, April 3 is Industry Day at the Capitol. Bill Ethier, the State HBRA Executive Officer will provide a briefing on important legislation impacting our industry. Information on these important issues are below. We hope if you cannot attend on April 3, you will reach out to your legislators. For help contacting them, please email or call us!

YOU CAN READ MORE ON EACH SPECIFIC ISSUE BY CLICKING ON THE LINKS BELOW.

Support SB 274 : To Prevent Increased Assessments on Homes Under Construction

Support HB 5045: Accountability for Fair & Affordable Housing Through Zoning

Oppose the Inclusionary Zoning Mandate on Multifamily Builders

Oppose SB 342: Severe Restrictions on AT Wastewater Systems

March 4, 2018 Update:

CT Housing Permits Issued 1980-2017: This graph clearly shows how we have yet to climb out of our decades-long housing recession.

It’s more important now than ever before to develop relationships with your legislators and explain how certain laws and regulations are negatively impacting our industry. See below for more information.

The Connecticut legislative session is underway and there are many major issues going through the committee process. We need your help contacting your legislators on issues that affect our industry and your businesses. It will only take a few minutes of your time.

Click here to read about our major bills.

⚠ IMMEDIATE ACTION NEEDED:

SB 274: An act concerning the assessment of municipal taxes on certain residential dwellings

Monday, March 5, there will be a public hearing on SB 274, our proposal to exempt homes under construction from higher tax assessments and the local property tax.

Under the bill, higher assessments would occur at the earliest of three triggers:

1) Issuance of a C.O.

2) Transfer of a deed to a buyer, or

3) Actual use as a residence

How can your input be heard? Your voice WILL make a difference and it only takes a few moments. Make phone calls and/or send emails today!

To take action on our proposal to exempt homes, under construction from higher tax assessments and the local property tax, contact the legislators who serve on the Planning & Development Committee.

The contact list with phone and emails for the committee is here.

For more information on why we support the bill, read our talking points.

CT STATE BUDGET

Governor Malloy’s budget proposal earlier this month included a series of new taxes and fees as a means of closing Connecticut’s $245 million budget deficit.

The governor’s proposed taxes and fees were submitted to the General Assembly in a bill titled SB 10. The bill includes:

- A hike in the tax on real estate conveyances from .75 to .85, and 1.25 to 1.4 percent.

- Installing tolls on Connecticut highways. Contrary to popular belief, these will not be installed on the borders, but rather throughout the state. Read why here.

- A new tax on nonprescription drugs and medicines.

- A new CT Tire Tax of $3 per tire.

- 7 cent increase in the gas tax to be phased in between 2019-2022. Unfortunately Connecticut already has the 6th highest gas taxes in the nation

- A penalty on businesses by maintaining a temporary surcharge on the corporation tax that was due to expire June 30.

- The elimination of the $500 credit on the income tax for recent college graduates who earn a degree in a science, technology, engineering, or math field.

Write an email to: FINtestimony@cga.ct.gov with a subject line “SB10” and CC: your legislator on the email. (Look up your legislator here).

- Your testimony can be 1 sentence or multiple paragraphs

- Speak from your experiences

- Sign your name, town of residence and we encourage you to mention you are a member of the HBRA of Fairfield County

Thank you for taking a few minutes to advocate on behalf of our industry. Any questions or concerns call Jackie at 203.335.7008 or email at Jackie@buildfairfieldcounty.com.